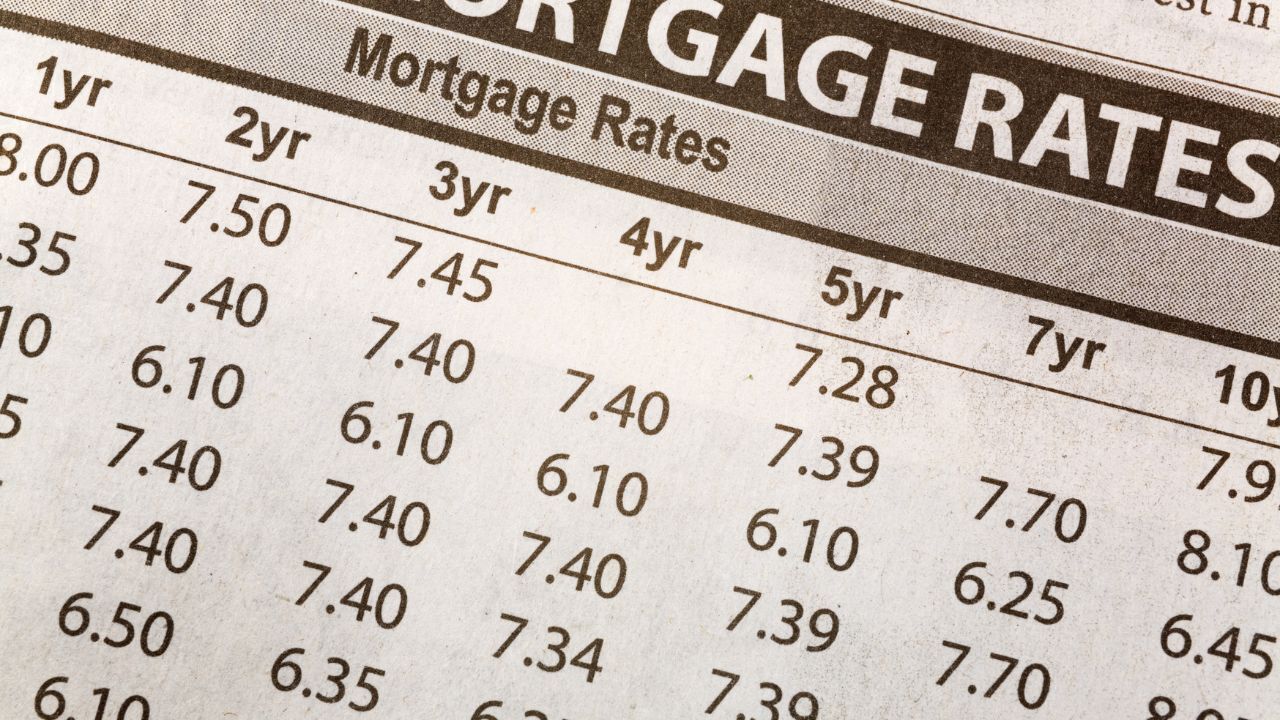

What’s Ahead For Mortgage Rates This Week – September 29th, 2025

The PCE (Personal Consumption Expenditures) Index, the Federal Reserve's preferred inflation measure, has been on the rise but remains within expectations. Although there was heavy speculation that this year's inflation would spike due to impactful tariff policies, it has largely stayed within forecasts--enough for the Federal Reserve to introduce a 25 basis point rate cut.

Read More

Financing Multiple Properties with One Mortgage

Owning multiple properties can be a smart investment strategy, but managing separate loans for each property can be complex and expensive. A blanket mortgage offers a solution by allowing homeowners or investors to finance two or more properties under a single loan. This type of mortgage can simplify payments, streamline management, and often provide better rates than holding multiple individual mortgages. Understanding how a blanket mortgage works and when it makes sense can help you maximize your real estate investments efficiently.

Read More

How to Use a Cash-Out Refinance Wisely

A cash-out refinance can be a powerful tool for homeowners who want to leverage the equity in their home, but it is important to approach it strategically. This type of refinance replaces your existing mortgage with a new, larger loan, giving you the difference in cash. Whether you are planning home improvements, consolidating high-interest debt, or investing, using a cash-out refinance wisely can help you reach your financial goals without creating unnecessary risk.

Read More

Smart Ways to Use Bonuses, Inheritances and Tax Refunds for Your Mortgage

Unexpected financial windfalls such as work bonuses, tax refunds, or inheritances can create exciting opportunities. While it may be tempting to spend these funds quickly, using them toward your mortgage can bring lasting financial benefits. Understanding the ways windfalls can strengthen your mortgage strategy will help you make the most of these resources.

Read More

Financing Mixed Use Properties: Live, Work, and Invest in One Place

Mixed use properties are becoming an attractive option for buyers who want to combine residential, commercial, and investment opportunities all in one place. These properties can provide unique benefits, such as generating rental income while also serving as a primary residence. However, financing a mixed-use property requires a different approach than financing a traditional single-family home, and understanding the process is key to making the right decision.

Read More

What’s Ahead For Mortgage Rates This Week – September 22nd, 2025

It has been a relatively light week following the recent rate changes, as the Federal Reserve has felt the need to drop the current rate by 25 basis points. They have also mentioned the possibility of two additional rate cuts within this year. This follows the recent sharp criticism from the current administration, which condemned the Federal Reserve's insistence on maintaining existing interest rates.

Read More

Myths About Mortgages That Still Fool Homebuyers

Buying a home is one of the biggest financial decisions most people will ever make, and the mortgage process can feel overwhelming. With so much information available, it is easy for myths to spread, and many homebuyers still believe ideas that are simply not true. Clearing up these misconceptions can make the path to homeownership less stressful and much more successful.

Read More

Deciding Whether to Pay Extra Toward Principal or Save for Other Investments

When it comes to managing your mortgage, one of the most common questions is whether to put extra money toward paying down the loan principal or to save that money for other investments. Both choices have advantages, and the right decision often depends on your goals, financial situation, and comfort with risk.

Read More

How Borrowers Can Benefit from Inflation with the Right Mortgage

Inflation is a topic that impacts nearly every part of the economy, from the cost of groceries to long term financial planning. For homeowners and those considering a mortgage, inflation can feel intimidating. However, with the right perspective and strategies, borrowers can use inflation to their advantage and create lasting financial benefits.

Read More

How Parenthood Changes Mortgage Needs and Housing Priorities

Becoming a parent is one of life's most exciting milestones. Along with the joy and responsibility of raising children, many families find that their housing needs and mortgage priorities change dramatically once little ones arrive. What may have worked for a single person or a couple often needs to be reevaluated when planning for the comfort, safety, and growth of a family.

Read More

What’s Ahead For Mortgage Rates This Week – September 15th, 2025

Both the CPI and PPI came in precisely within expectations. Under the current circumstances, there is now a very high probability that the Federal Reserve will implement a quarter-point rate cut, a view widely shared by industry analysts. There is also a strong possibility of another cut to follow.

Read More

Strategies to Save on Your Mortgage in a Rising Rate Environment

When interest rates climb, homeowners and buyers alike often feel pressure on their monthly budgets. Fortunately, there are strategies that can help you save money and manage your mortgage more effectively even in a rising rate environment. By making thoughtful adjustments and using available tools, you can still work toward long term financial security.

Read More

5 Key Steps in the Mortgage Underwriting Process

Buying a home can be exciting, but it can also feel overwhelming. Understanding the mortgage underwriting process can make things a lot smoother!

Read More

Understanding the Temporary Rate Reduction Mortgage

Buying a home is exciting, but the thought of monthly mortgage payments can feel overwhelming, especially for first-time buyers. One strategy to ease the financial burden is a temporary rate reduction. This type of mortgage allows borrowers to pay a lower interest rate for the first two years of the loan before it returns to the original fixed rate.

Read More

Why Credit Monitoring Matters During the Mortgage Process

Buying a home is one of the most significant financial decisions you will make. While it is exciting to pick out your dream home, the mortgage process can be complex and stressful. One critical factor that can make or break your journey is your credit. Credit monitoring gives you the insight and control you need to stay on track.

Read More

What’s Ahead For Mortgage Rates This Week – September 8th, 2025

The release of major inflation data has once again arrived with the Consumer Price Index and the Producer Price Index, offering insight into the current state of the economy. Based on recent statements from the Federal Reserve, there is considerable speculation that rate cuts may occur regardless of the trajectory of inflation.

Read More

Mortgages in a Rising Rate Environment: Strategies to Save

When interest rates begin to climb, many buyers feel uncertain about whether it is the right time to purchase a home. Higher rates can impact affordability and monthly payments, but that does not mean homeownership is out of reach. With the right strategies and preparation, you can still secure a mortgage that fits your budget and long-term goals.

Read More

How Cryptocurrency and Digital Assets Are Affecting Mortgage Approval

The rise of cryptocurrency and digital assets has transformed the way many people invest and build wealth. As more buyers hold Bitcoin, Ethereum, and other digital currencies, the question of how these assets impact mortgage approval has become more common. While lenders are beginning to recognize cryptocurrency, it is still a developing area that requires careful planning.

Read More

Mortgages for Newlyweds, Combining Finances and Buying Your First Home

Starting your life together as a married couple is an exciting season filled with new milestones. One of the biggest decisions many newlyweds face is whether to buy a home together. While combining households and finances can feel overwhelming, taking time to understand how mortgages work and planning together can set you up for long-term success.

Read More

What’s Ahead For Mortgage Rates This Week – September 2nd 2025

With the release of the PCE Index, inflation has shown to still be creeping upwards but there is significant speculation that the Federal Reserve will continue with their interest rate cut in the future. Meanwhile, the Consumer Sentiment report has been growing pessimistic amidst the job market, which has been shown to be in a pattern of cooling down. This is offset by the strong growth by the GDP estimates for the second quarter, as it was initially predicted the tariff changes would have a significant impact on the GDP estimates, but the impact has been less prominent than expected.

Read More